pay indiana business taxes online

Prepare to file and pay your Indiana business taxes. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one.

If You Have E Filed You Do Not Need To Send In Paper Forms Unless Requested By Indor Or The Irs Taxtiptuesday Intaxes Tips Irs Tax

Beginning July 7 2022 no.

. Business Tax Application form BT-1. You can file and pay with the Indiana DOR online using the Indiana Taxpayer Information Management Engine INTIME. Search for your property.

INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more. Make a payment online with INTIME by electronic check bankACH - no. To register for Indiana business taxes please complete the Business Tax Application.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one. Get more cash-flow instantly. Set up necessary business tax accounts List what the business does List which taxes will be collected and paid Complete an application for each.

Ad Pay rent taxes inventory any other business bill with your credit card to extend float. Get a personalized recommendation tailored to your state and industry. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more.

INTAX only remains available to file and pay the following obligations until July 8 2022. If the business cannot locate. Search by address Search by parcel number.

Create an INtax Account. Ad Find out what tax credits you qualify for and other tax savings opportunities. After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business.

For best search results enter a partial street name and partial owner name ie. Vendors receive a bank deposit or a check in the mail. 124 main rather than 124 main street or doe rather than john doe.

INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales. 124 Main rather than 124 Main Street. Get a personalized recommendation tailored to your state and industry.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. DOR Tax Forms Online access to download and print DOR tax. Indiana businesses have to pay taxes at the state and federal levels.

You may also need to complete the FT-1 application for motor fuel taxes including special fuel or. These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July. Make a payment online with intime by.

All other business tax obligations. You can contact DOR for help with INtax to manage the tax obligations listed above at 317-232-2240 Monday through Friday 8 am. Beginning July 18 2022 ALL tax types will be filed and paid via INTIME.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. To file andor pay business sales and withholding taxes please visit intimedoringov. If a business does not pay its tax liability the RRMC will expire.

Ad Find out what tax credits you qualify for and other tax savings opportunities.

Indiana Sales Tax Small Business Guide Truic

If You Have Employees Who Work In One State But Live In Another You Might Need To Know About Tax Resume Examples Introduction Letter Child Support Enforcement

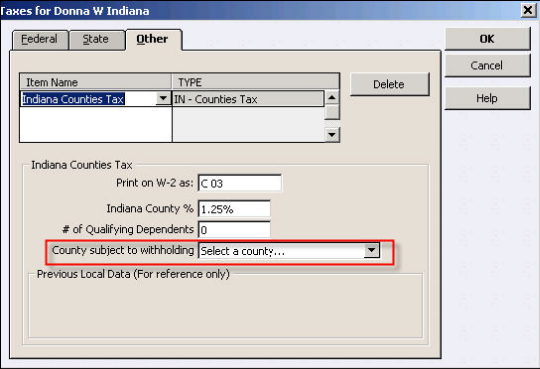

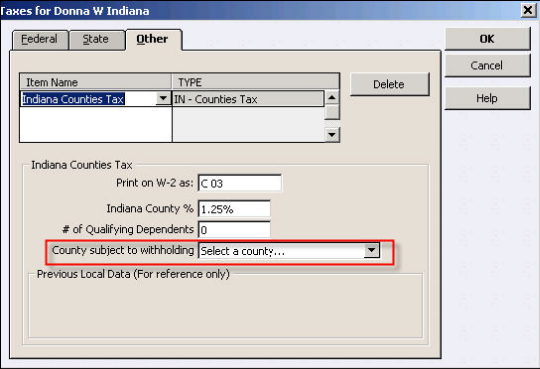

Quickbooks Payroll Indiana Counties Tax Filing Enhancement

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Indiana Tax Id Online Application How To Apply For A Tax Id Ein Online Business Learning Center

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

40 How To Fill Out Schedule C For Business Taxes Youtube Business Tax Business And Economics Federal Income Tax

Solved Indiana Withholding Setup In Quickbooks Payroll

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Sem Is The Best Way Of Promoting A Site To Developing Business Strategies To Improve Our Site And Product To Show In S Ppc Advertising Ppc Marketing Techniques